Dubai, UAE – Dubai’s real estate market has solidified itself as a premier investment destination in 2025, frequently outshining traditional global property hubs such as London, New York, and Toronto. This analysis explores key metrics such as rental yields, property taxes, foreign ownership regulations, capital gains taxation, and residency visa prospects to provide a comprehensive comparison for international investors, including a strong focus on Indian investors eyeing Dubai’s attractive market.

Higher Rental Yields Maintain Dubai’s Appeal

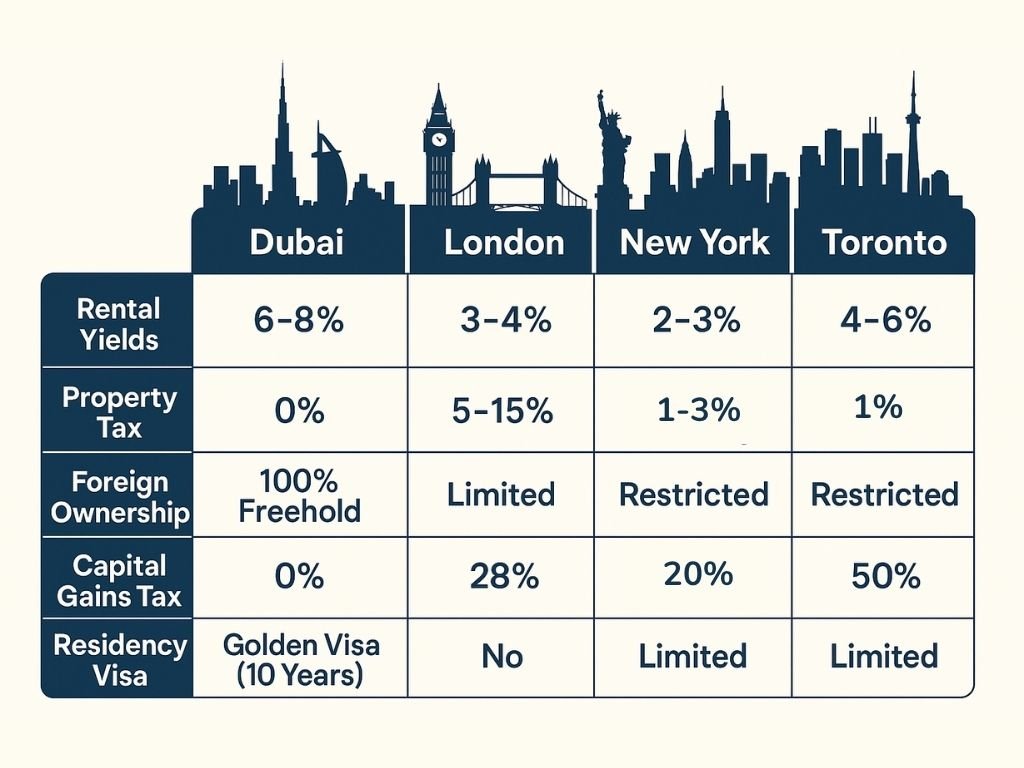

Dubai offers consistently higher rental yields than its global counterparts, a critical factor driving its investment allure. According to Engel & Völkers, some of Dubai’s prime residential communities achieved exceptional rental yields in 2025, ranging between 6% and 8%, with specific hotspots like Jumeirah Village Circle nearing 7.6% and Dubai Silicon Oasis topping 8%.

In comparison, London’s rental yields hover between 3% and 6%, according to Intracapital Estates, reflecting tighter supply and higher prices in its core districts. New York property investors typically encounter yields in the 2% to 3% range, impacted by higher taxation and operational costs. Toronto’s yields are somewhat more competitive, standing between 4% and 6% according to Ontario Housing Market data. These differences emphasize Dubai’s strong cashflow potential amid ongoing population growth and rental demand continuity.

Property Tax: Dubai’s Zero Burden Versus Global Variations

Dubai offers investors a distinct advantage with zero annual property tax, creating a highly efficient investment environment. This absence of property tax reduces holding costs significantly compared to global peers.

Also read: Binghatti Prices $500m Oversubscribed Green Sukuk

In contrast, London property investors shoulder combined costs between 5% and 15% annually, factoring in council tax and hefty stamp duties on transactions. New York residents face property tax rates ranging from 1% to 3%, varying widely by borough and property class. Toronto’s 2025 residential tax rate is estimated at approximately 0.66-1%, combining municipal taxes and levies.

Foreign Ownership Laws: Dubai’s Full Freehold Access

Dubai stands apart with full freehold ownership rights available to foreigners within many communities—an attractive proposition for international investors seeking straightforward property tenure. This openness contrasts with London’s limited ownership conditions, where foreign buyers face steep stamp duties and financing challenges without residency privileges.

New York allows foreign ownership but imposes restrictions on financing and local taxes. Toronto has introduced stringent restrictions and a 10% tax targeted at foreign buyers to manage housing affordability, effective 2025, including bans on non-resident purchases until 2027.

Capital Gains Tax: Dubai’s Zero Rate Versus Global Tax Burdens

One of Dubai’s most compelling advantages is the absence of capital gains tax on property sales, a factor that greatly enhances net profitability.

London recently reduced its residential capital gains tax rate from 28% to 24% for higher-rate taxpayers, effective April 2025. New York investors face federal capital gains rates between 15% and 20%, with additional state and city income taxes applying, which can cumulatively exceed 30%. In Canada, capital gains are taxable as 50% of the gain being included as income, subject to regular income tax rates, contrary to the misleading 50% flat tax sometimes referred to.

Residency Visa Incentives: Dubai’s Golden Visa Leads

Dubai offers foreign investors a 10-year Golden Visa, linking property ownership to residence opportunities—a significant advantage for long-term investors who wish to secure stable residency rights. London discontinued its Tier 1 investor visa, so property acquisition no longer provides residency.

In the US, property ownership provides no direct path to citizenship or visa status. Similarly, in Toronto, residency is limited, and investors must pursue other immigration pathways.

Practical Perspectives For Indian Investors

Dubai continues to be a magnet for Indian investors, drawing appeal through high rental yields, tax efficiency, and a fast-growing economy. Strada UAE’s analysis highlights Dubai’s attractiveness as an accessible market with strong lifestyle appeal and relatively low entry barriers compared to traditional global cities.

“Dubai’s real estate stands out for its robust return potential and investor protection mechanisms,” says Andrew Cummings, Head of Prime Residential at Knight Frank Middle East. “Indian investors, in particular, benefit from seamless visa access, competitive financing, and vibrant community networks,” he adds.

According to Walkestate.com’s 2025 guide, Indian investors value Dubai’s stable regulatory environment, tax exemptions, and rental returns—making it a top choice for portfolio diversification.

Dubai’s 2025 real estate market remains a standout for global investors, combining higher rental yields, no property or capital gains taxes, greater foreign ownership freedoms, and residency incentives. While London, New York, and Toronto offer established markets with their own strengths, Dubai’s unique blend of fiscal benefits and rapid growth creates a compelling value proposition.

Indian investors seeking secure, high-yield real estate opportunities will find Dubai’s market particularly appealing amid rising international competition and evolving regulatory landscapes.

Discover more from Invest Dubai Today - Dubai Realty Insights

Subscribe to get the latest posts sent to your email.