Dubai, UAE – A recent post on Reddit reignited debate about whether Jumeirah Village Circle (JVC), one of Dubai’s most active residential communities, is heading toward oversupply. The poster claimed that JVC already has about 40,000 completed homes, with a further 30,000 due for delivery in the next two years — an 80% increase that could push the area’s housing stock to 70,000 units by 2026. Based on those numbers, the user argued that JVC would be able to accommodate 144,000 residents, far more than the roughly 80,000 who live there today.

Such figures fuel investor anxiety, but a review by Invest Dubai Today of official reports and consultancy data shows the claim exaggerates both the pace of new deliveries and the scale of the demand gap. While JVC does face short-term supply pressure, particularly in 2025, the risk of a dramatic glut is far lower than online speculation suggests.

Supply: Slower Than Reddit Claims

JVC has consistently ranked among Dubai’s most active zones for residential handovers, but the numbers fall short of the Reddit claim.

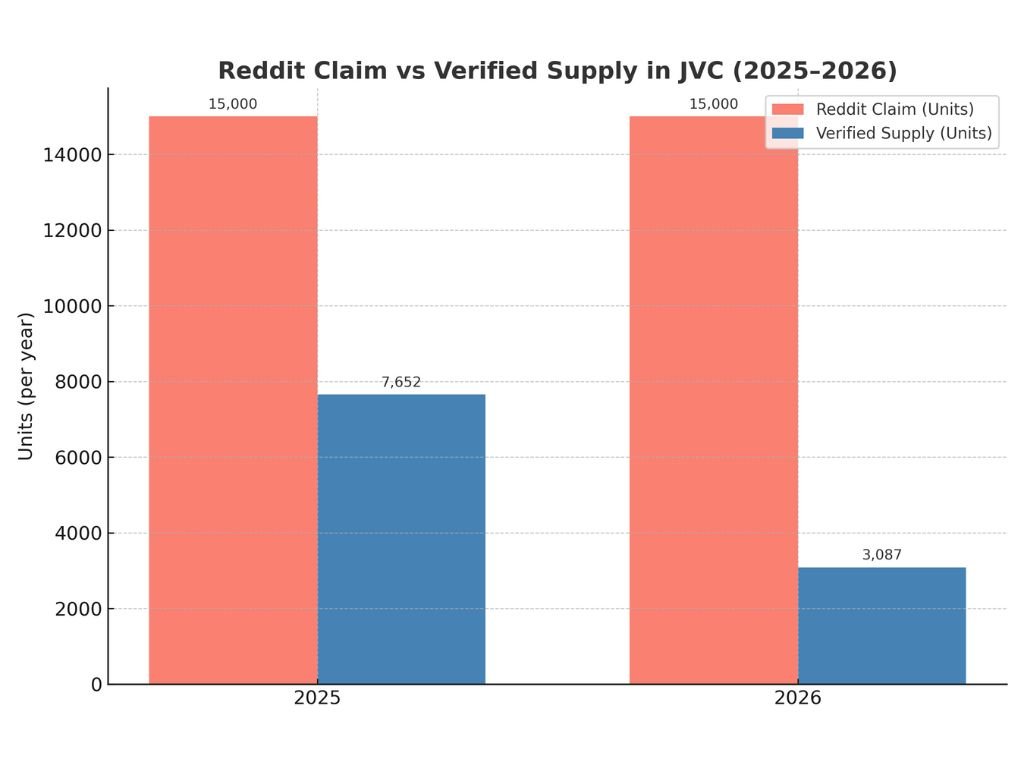

Provident Real Estate’s second-quarter 2025 market report shows that 7,652 apartments are scheduled for completion in JVC this year, the highest of any single community. The consultancy noted that the influx would “slightly exceed demand” in the short term.

Figures from Betterhomes add context: Dubai delivered more than 20,000 new homes in the first half of 2025, with JVC accounting for roughly 20% of those completions. That suggests about 4,000 units were handed over in JVC in just six months, confirming its position as one of the busiest delivery zones in the city.

Looking forward, Morgan’s Realty forecasts that Dubai will add 37,171 homes in 2025, though only about 62% of that total is expected to materialise, given the city’s history of construction delays. JVC’s contribution to that pipeline is about 3,087 units, according to the same report. The consultancy expects similar slippage in subsequent years: of the 71,613 units forecast for 2026, only about 34,740 are likely to be completed, with the balance delayed into later years.

These figures indicate that while JVC is absorbing thousands of new homes, the 30,000-unit surge described on Reddit is unlikely to occur within a two-year window.

Population Growth and Market Absorption

The Reddit post also argued that JVC’s potential stock of 70,000 homes would equate to capacity for 144,000 people, far above current population levels. That calculation assumes static demand, but Dubai’s demographics tell a different story.

The emirate’s population surpassed 4 million in 2025 and is growing by around 200,000 people per year, according to Dubai Statistics Center. If JVC captures just 3% of new arrivals, the community would add about 6,000 residents annually. Based on average household sizes of 2.5 to 3 people, that equates to demand for roughly 2,000 to 3,000 homes each year.

Beyond end-user demand, JVC attracts significant investor interest. Betterhomes data shows it was one of the most popular locations for leasing activity in 2024–25, with a sizeable portion of units absorbed as rental stock or short-term holiday homes.

The community’s market performance reflects that strength. According to Dubai Land Department records, JVC recorded more than 6,500 property sales in 2024, ranking among the top five areas in the emirate. Prices have continued to rise: average apartment values increased 16% year-on-year to about AED 1,050 per square foot, while villas rose 19% to AED 950 per square foot. Rental yields remain well above the city average, with studios generating 8–9%, one-bedrooms 7.5–8%, and two-bedrooms 7–7.5%.

This resilience suggests that even with rising supply, demand has kept pace better than Reddit commentary implies.

Infrastructure: A Pressure Point

Where Redditors were more accurate is on infrastructure. Traffic bottlenecks on Hessa Street and Umm Suqeim Street are a frequent source of resident complaints, and congestion could weigh on the pace at which new stock is absorbed. The government has pledged AED 86 billion in infrastructure spending for 2025 under its D33 agenda, including road upgrades in and around JVC, but execution will determine whether those projects alleviate pressure quickly enough.

Verdict: Risk is Real, But Scale is Exaggerated

Taken together, the data show that JVC will face short-term oversupply in 2025, with more than 7,600 units scheduled for handover and thousands already delivered in the first half of the year. That supply may temporarily outstrip demand, leading to stiffer competition for tenants and possible pressure on yields in some clusters.

But the notion of an 80% surge in two years, as suggested on Reddit, is unsupported by the evidence. Delivery delays, phased completions, and Dubai’s strong population growth make it far more likely that the community’s pipeline will be absorbed over a longer horizon.

For investors, the lesson is not to avoid JVC, but to be selective. Projects by reputable developers and homes in well-connected clusters are likely to hold value. Weaker builds and areas with lagging infrastructure may see slower take-up.

In short, JVC is crowded, but it is not collapsing.

Discover more from Invest Dubai Today - Dubai Realty Insights

Subscribe to get the latest posts sent to your email.