Sharjah, UAE – Sharjah-based developer Arada has announced its expansion into the United Kingdom with the acquisition of a 75% stake in Regal, a leading London residential-led mixed-use developer.

The AED2.5 billion ($680 million) deal marks the rebranding of Regal into Arada London, underlining the UAE developer’s second major international expansion after entering Australia in 2024.

Sheikh Sultan bin Ahmed Al Qasimi, Chairman of Arada, said:

“London is one of the world’s leading cities, and our expansion into this market represents a strategic step for Arada in response to the strong demand for residential space. This investment provides a significant opportunity to accelerate the delivery of new residential assets in London, fully aligned with Arada’s long-term strategy to develop high-quality projects that enable people to live healthier and more prosperous lives.”

Expanding Regal’s Residential Pipeline

The acquisition accelerates the delivery of Regal’s existing 10,000-unit pipeline across 11 projects, with a goal to more than triple this over the next three years.

Also read: Azizi Rêve in MBR City Construction Progress Reaches 56%

Since its inception nearly 30 years ago, Regal has delivered more than 4,000 residential units and 1 million square feet of commercial space. Its integrated model covers the entire asset lifecycle from land acquisition to construction, marketing, and asset management.

Regal’s current projects include Fulton & Fifth in Wembley, a mixed-use scheme comprising 876 homes—40% of which are affordable housing—alongside the Regal Academy, which trains and employs local and military community members.

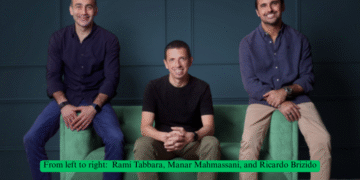

Jonathan Seal, Chief Executive of Regal, said:

“With nearly 30 years of successful partnerships behind us, Regal has built a reputation for aligning with businesses that share our long-term vision and deep understanding of the real estate industry. It is in this spirit that we have carefully chosen Arada as our partner, a business that shares our values and confidence in the London residential market and our management team’s ambition to continue growing market share and shaping the London skyline.”

GCC Developers Increasing London Presence

Arada joins other major GCC developers such as Damac, Dar Global, and Aldar, which have expanded their footprint in London in recent years.

Also read: Aspect Development to Launch First Abu Dhabi Project with Aldar

According to the UK-based Al Rayan Bank’s 2024 GCC Investment Barometer, GCC investors spent an average of AED558 million on London property in 2024, up from AED450 million the previous year. London also overtook Miami, New York, Los Angeles, and Paris in popularity among Gulf investors.

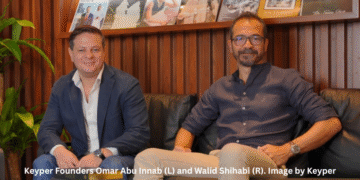

Ahmed Alkhoshaibi, Group Chief Executive Officer of Arada, said:

“We have been impressed by the platform the Regal team has built, as well as the inspirational schemes they are delivering, which reflect our own, long-term focus on experience, amenity, and the customer. Leveraging Arada’s extensive design and placemaking capabilities, delivery track record and capital resources, we are well placed to support Regal’s evolution and unlock new opportunities for growth.”

Arada’s Global Growth Strategy

Founded eight years ago, Arada has launched 10 projects in the UAE, including Aljada, one of the nation’s largest mixed-use communities, the bestselling Masaar forested community, and the luxury Armani Beach Residences at Palm Jumeirah.

In Australia, Arada is developing nine projects across New South Wales, totaling 5,000 residential units. Its global pipeline now exceeds 42,000 units valued at over AED95 billion, with more than 10,000 already delivered.

The company, rated B1 by Moody’s and B+ by Fitch, brings capital strength and large-scale development expertise into the UK market under the Arada London real estate investment banner.

Perspectives For Indian Investors In Dubai

Arada’s expansion into London provides a dual opportunity for Indian investors looking at global diversification. London continues to attract GCC capital due to high yields and stability, while Dubai remains a preferred investment hub for Indian buyers because of its proximity, tax efficiency, and strong rental returns.

For Indian investors already active in Dubai, Arada’s international growth underscores the resilience of UAE developers and offers reassurance about the long-term value of assets tied to their brand. Investing in projects linked to developers with proven global track records often reduces perceived risk while opening access to cross-border opportunities.

Discover more from Invest Dubai Today - Dubai Realty Insights

Subscribe to get the latest posts sent to your email.