Dubai, UAE — DIFC branded residences continue to expand as Aman Group partners with H&H to launch Janu Residences within Dubai International Financial Centre. The move reinforces DIFC’s evolution from a purely financial district into a fully integrated live-work urban core with constrained residential supply.

With ultra-prime inventory in central business districts remaining limited, each new residential addition in DIFC carries structural significance for pricing depth, long-term scarcity, and investor positioning.

Launch of Janu Club

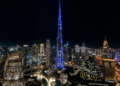

The project comprises a 150-key hotel, the region’s first Janu Club, and a limited collection of 57 two- to five-bedroom residences. The tower will rise from a reimagined souk courtyard within DIFC, with the hotel occupying levels 6 to 16 and residences positioned on upper floors overlooking Zabeel Palace Gardens, the Burj Khalifa, and the DIFC skyline.

Also read: DIFC Launches First Homes in Zabeel District as Central Supply Tightens

Designed by Herzog & de Meuron, the development marks the firm’s first residential project in the Middle East. The residences will offer direct access to hotel amenities including wellness facilities, restaurants, and social spaces.

Vlad Doronin, Chairman and CEO of Aman Group, said: “With Janu Dubai we are creating more than a place to stay. Cultivating sociability, shaped by creativity, bold design and vibrancy, Janu Residences embodies the essence of the brand.”

The project follows the opening of Janu Tokyo in 2024 and represents the brand’s first residential offering in the Middle East.

Scarcity in the Financial Core

Unlike waterfront districts where land supply remains comparatively flexible, DIFC operates within a tightly defined urban footprint. Most plots are already developed or allocated for commercial use, leaving limited room for additional residential stock.

This structural constraint supports long-term pricing resilience in the DIFC branded residences segment. Demand in this district typically stems from senior executives, global investors, and business owners who prioritise proximity to financial infrastructure and cultural venues over yield optimisation.

As DIFC broadens its liveability proposition, residential projects are increasingly viewed as part of the district’s ecosystem rather than standalone developments.

Branded Residences and Market Depth

Dubai ranks among the world’s leading markets for branded residences, according to international consultancy reports, but most supply remains concentrated in waterfront or resort-style districts. The expansion of DIFC branded residences signals continued appetite for hospitality-linked homes in core business zones.

Doronin noted that the tower introduces a different architectural tone within DIFC’s skyline. “Designed by Pritzker Prize–winning practice Herzog & de Meuron, the tower has a tactile, mineral quality and a sculptural form that gives it a distinctive identity in Dubai’s polished skyline while introducing a more human scale to DIFC,” he said.

The integration of terraces and planted outdoor areas reflects a design response to vertical urban living, which remains relatively rare in DIFC’s high-rise inventory.

Investor Positioning

From an investment perspective, DIFC branded residences sit within a specialised ultra-prime segment. These assets typically attract capital seeking long-term positioning rather than short-term rental arbitrage.

Also read: The Carlyle Residences Dubai Launch Brings Iconic New York Legacy to DIFC

Transaction liquidity at this level depends on international capital flows and global wealth cycles. While scarcity supports value preservation, exit timelines can be longer than in mid-market districts where trading volumes are higher.

As additional branded projects enter Dubai’s broader pipeline, differentiation by location, architectural pedigree, and operator strength becomes increasingly important. In DIFC’s case, district positioning remains the primary anchor of demand.

Doronin added that the development integrates nature within a vertical format. “Embracing a meaningful connection to nature, it will integrate expansive outdoor terraces and balconies enriched with abundant planting and gardens, creating a verdant, pedestrian-focused environment that is rare for a high-rise in the UAE.”

What Comes Next

Sales uptake and pricing benchmarks will provide early indicators of depth within the DIFC branded residences segment. Market participants will assess how this launch performs relative to waterfront ultra-prime offerings and other hospitality-backed towers entering the market.

For Indian and NRI investors operating at the upper end of the market, DIFC remains one of the few centrally located freehold districts offering proximity to both business and lifestyle infrastructure. Currency positioning, global wealth migration trends, and overall liquidity in the ultra-prime bracket will continue to shape capital deployment decisions.

The launch of Janu Residences adds another layer to DIFC’s gradual residential expansion. For investors, it reflects confidence in core-district scarcity and the continued evolution of branded living within Dubai’s financial centre. For end-users, it reinforces the district’s transition toward a balanced urban environment where residential, hospitality, and commercial functions increasingly intersect. As DIFC branded residences expand, the key variable will be how the district sustains exclusivity while accommodating measured growth.

Discover more from Invest Dubai Today - Dubai Realty Insights

Subscribe to get the latest posts sent to your email.