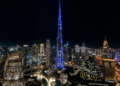

Dubai, UAE — Dubai’s property cycle continues to show resilience at scale, with Emaar FY2025 results confirming sustained absorption across master-planned communities and new launches. The performance offers a system-level indicator for investors tracking demand depth in the emirate’s largest developer portfolio.

Emaar reported its highest-ever property sales of AED 80.4 billion in 2025, up 16% year-on-year. The growth reflects sustained transaction activity across established communities and newly launched projects.

Revenue for the year reached AED 49.6 billion, rising 40% compared to 2024, while EBITDA climbed 33% to AED 25.6 billion. Net profit before tax increased 36% to AED 25.7 billion.

The strength of Emaar FY2025 results reinforces the role of large master developers as barometers of pricing power and liquidity conditions in Dubai’s residential market.

Backlog Visibility and Earnings Cushion

Driven by strong sales momentum, Emaar’s revenue backlog expanded 39% to AED 155 billion as of December 31, 2025. The backlog provides multi-year revenue visibility, supporting earnings continuity through upcoming delivery cycles.

Also read: Emaar Development Q3 2025 Results Show 49% Profit Growth as Dubai Market Expands

At current conversion rates, this backlog offers forward revenue certainty at what the company described as healthy margins.

For investors, backlog expansion at this scale signals continued buyer confidence, particularly in premium and upper-mid segments where Emaar has maintained consistent launch velocity.

Dividend Signal and Balance Sheet Strength

Supported by sustained performance, the board recommended maintaining dividends at 100% of share capital for 2025.

The dividend decision reflects confidence in liquidity and capital discipline. Emaar also retains one of the region’s largest diversified land banks, comprising approximately 618 million square feet of mixed-use development opportunities, including 344 million square feet in the UAE.

This land reserve provides optionality across market cycles and reduces near-term land acquisition pressure, an increasingly relevant factor as land prices in Dubai remain elevated.

Domestic Growth Driving Performance

Revenue growth was primarily driven by domestic operations, underlining Dubai’s role as the group’s principal earnings engine.

Also read: Emaar Launches Terra Gardens At Expo Living In Dubai South

Mohamed Alabbar, founder of Emaar, said: “Our 2025 results were shaped by a business environment that enables ambition and rewards long-term thinking. The UAE Government and the city of Dubai have created a framework built on stability, clear regulation, and openness to global investment, allowing companies like Emaar to plan with confidence, scale responsibly, and focus on execution. This foundation has been critical to our ability to grow, innovate, and deliver enduring value for our customers and partners.”

The statement aligns with broader market indicators showing sustained liquidity in both off-plan and ready segments.

Pipeline Scale and Delivery Discipline

Beyond sales performance, execution scale is expanding. The company’s development platform now spans residential, retail, hospitality, and international assets, reinforcing diversification across revenue streams.

Emaar’s 2026 New Year celebrations in Downtown Dubai, which drew approximately 2.8 million visitors, further strengthened destination branding across its core assets.

While destination performance enhances ecosystem value, the key structural takeaway from Emaar FY2025 results lies in pipeline strength. The company’s scale implies substantial delivery volumes into 2026–2028, aligning with Dubai’s broader supply cycle.

Market Context and Cycle Position

Dubai’s transaction volumes reached record levels in 2025, supported by population growth, capital inflows, and strong off-plan activity. Large master developers have benefited from buyer preference for established communities offering infrastructure certainty and amenity depth.

However, the next phase of the cycle will test execution discipline.

With supply entering the market over the next two years, sales velocity and margin management will become increasingly important. The ability to convert backlog into timely handovers without margin compression will be a critical metric.

For now, Emaar FY2025 results suggest demand absorption remains intact at scale.

Risk and Execution Considerations

Despite record numbers, risks remain.

Large backlog positions increase exposure to construction cost pressures and delivery timelines. Margin sustainability will depend on maintaining pricing power amid growing pipeline completions across Dubai.

Additionally, luxury absorption depth will be closely monitored in 2026 as more premium inventory enters the ready segment.

The current performance reflects strength in expansionary conditions; the next test will be margin resilience in a higher-supply environment.

What To Watch Next

Investors will closely monitor backlog conversion into 2026 revenue, delivery volumes relative to market absorption, and margin trajectory as supply increases. Dividend sustainability in future cycles will also remain under scrutiny.

The performance signals continued stability in the master developer segment, but forward earnings quality will hinge on disciplined execution.

Closing Analysis

For investors, Emaar FY2025 results reinforce earnings visibility, dividend reliability, and land bank optionality in a market that remains liquidity-rich. The backlog provides insulation against short-term volatility.

For end-users, strong master developer performance suggests pricing stability in established communities, though increased deliveries may moderate resale velocity.

For Indian and NRI buyers, scale and balance sheet strength reduce execution risk, particularly in premium master-planned districts. Entry timing decisions are likely to be driven more by specific location dynamics than broader market stress signals.

Discover more from Invest Dubai Today - Dubai Realty Insights

Subscribe to get the latest posts sent to your email.