DUBAI, UAE – Omniyat has secured a total of $900 million through sukuk offerings in 2025, as the Dubai developer deepens its presence in international debt capital markets.

The company recently priced a $400 million 3.5-year sukuk, its second issuance in less than six months. The sukuk will be listed on the London Stock Exchange’s International Securities Market and Nasdaq Dubai in the coming days.

The latest offering attracted robust demand from both regional and global investors, with the orderbook peaking above $1 billion and closing at more than $800 million, more than twice the issue size. The sukuk carries a profit rate of 7.25%, representing a tightening of 112.5 basis points compared with Omniyat’s debut issuance earlier this year.

Also read: Buyer Intent in UAE Property Market Remains Strong, Says Property Finder

“This strong demand and improved pricing reflects the market’s recognition of our robust development program and growth trajectory, and allows us to continue delivering on our strategy,” said Mahdi Amjad, Founder and Executive Chairman at Omniyat.

Strengthening Market Position

The new issuance extends Omniyat’s debt maturity profile beyond its outstanding 2028 sukuk and supports the company’s financial strategy. Both S&P and Fitch Ratings assigned a ‘BB-’ rating with a stable outlook to the sukuk, which was issued under Omniyat Sukuk 1 Limited’s $2 billion Trust Certificate Issuance Programme.

Also read: Sharjah Real Estate Transactions Surge 76% to AED4.9 Billion in August

“Issuing a second sukuk within just six months of our debut – and on even better terms – is a major step forward for Omniyat. It shows the depth of confidence that global investors have in our vision, our discipline, and in the continued strength of Dubai’s ultra-luxury real estate market,” Amjad said.

Previous Green Sukuk and Development Pipeline

In May 2025, Omniyat raised $500 million through a three-year green sukuk, marking its first entry into the international debt capital markets.

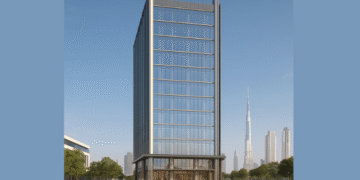

The developer has also been active on the project front this year. In June, it launched Lumena, a 48-storey commercial tower in the Burj Khalifa District that sold out with a total transaction value of AED 3.40 billion, the highest recorded in Business Bay to date. Omniyat also announced the acquisition of Marasi Bay Island, further expanding its master-planned waterfront ecosystem anchored by The Lana and Vela Viento.

Discover more from Invest Dubai Today - Dubai Realty Insights

Subscribe to get the latest posts sent to your email.