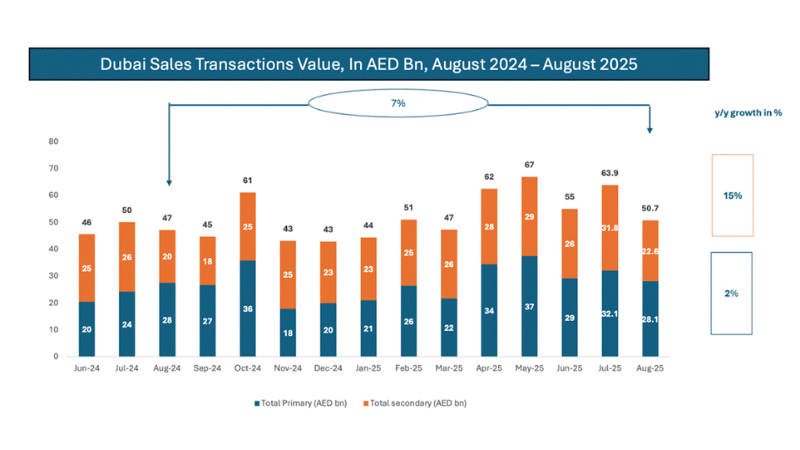

DUBAI, UAE – Dubai’s property market maintained its upward trajectory in August, with sales transactions rising 15% year-on-year to 18,564 deals worth AED 50.7 billion, according to new data from Property Finder.

The surge was fuelled by a sharp increase in off-plan activity, where volumes jumped 25% and values rose 11% compared with August 2024. Secondary off-plan deals stood out, with 1,978 transactions worth AED 4.1 billion – up 59% in volume and 69% in value year-on-year.

Cherif Sleiman, Chief Revenue Officer at Property Finder, said,

“August’s figures offer a clear picture of Dubai’s real estate market strength, driven by an off-plan surge and bolstered by consistently healthy secondary activity. What’s remarkable this month is how neighbourhoods like Business Bay and Wadi Al Safa 4 are outperforming the broader trend, demonstrating that both investor confidence and demand for emerging communities remain elevated.”

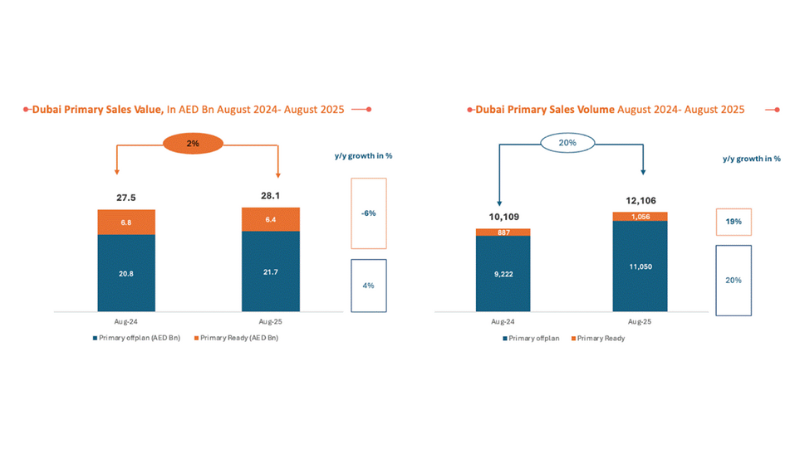

Primary market performance

The primary market dominated August activity with 12,106 transactions, up 20% from a year earlier. Off-plan sales accounted for 91% of these deals. While values rose a more modest 4%, Business Bay emerged as a standout performer, contributing 11% of overall volume and 12% of value, with growth of 377% and 290% respectively. Dubai Investment Park also ranked among the top contributors, representing 9% of both volume and value.

Secondary sales trends

Also read: Palm Jumeirah Villa Sold for AED161m in Dubai’s Top 2025 Deal

Secondary market transactions reached AED 22.6 billion across 6,458 deals, a 15% rise in value and 7% growth in volume. Demand in emerging areas strengthened, particularly in the secondary off-plan segment. Wadi Al Safa 4 registered AED 786 million in sales, a sharp increase from AED 26 million last year, while Al Barsha South Fourth saw sales values climb 154% and volumes up 142%.

Shifting consumer preferences

Apartments remain the preferred choice, accounting for 59% of buyer interest and nearly 80% of rental searches. Studios represent 22% of rental demand but only 16% of buyer demand, while one-bedroom apartments continue to attract the largest share – 36% of buyer searches and 40% of rental interest. The rising tilt toward studios and one-bedroom units suggests tenants are moving into ownership of affordable homes to offset rising rents.

The strength in off-plan and secondary sales comes against a backdrop of strong developer performance. Emaar recently reported a 33% increase in H1 profits, while several developers are bringing construction in-house to accelerate delivery amid demand. Sleiman noted that such moves reflect Dubai’s proactive market stewardship and growing appeal to both investors and end-users.

Perspective for Indian investors

For Indian investors, Dubai’s off-plan market offers an attractive entry point, given flexible payment plans and strong capital appreciation prospects in emerging communities. Areas like Business Bay and Wadi Al Safa 4, which are recording outsized growth, may appeal to those seeking early-mover advantage. The continued strength of smaller-unit demand also suggests that Indian buyers looking for long-term rental yield could find opportunities in affordable apartment categories.

Discover more from Invest Dubai Today - Dubai Realty Insights

Subscribe to get the latest posts sent to your email.