Dubai, UAE — The Dubai and Abu Dhabi real estate market Q3 2025 performance hit new highs, with both emirates registering record-breaking transaction values and volumes, underscoring sustained investor confidence and strong fundamentals in the UAE property sector.

According to Property Finder’s latest data, Abu Dhabi recorded a 76% year-on-year increase in total sales transactions, reaching 7,154 deals worth AED 25.3 billion, while Dubai achieved 59,044 transactions, up 17% from a year earlier, with a total value of AED 169 billion. The figures mark the highest quarterly results ever recorded in both markets.

Abu Dhabi’s Growth Anchored in Strategic, Sustainable Development

Abu Dhabi’s real estate sector continued its impressive trajectory, bolstered by liquidity improvements and a clear policy direction toward sustainable, master-planned communities. The residential sector was the primary growth driver, accounting for 96% of total transactions valued at AED 23.3 billion, representing a 107% annual rise.

Also read: Dubai Real Estate Exit Strategies: When to Sell and Maximise Returns

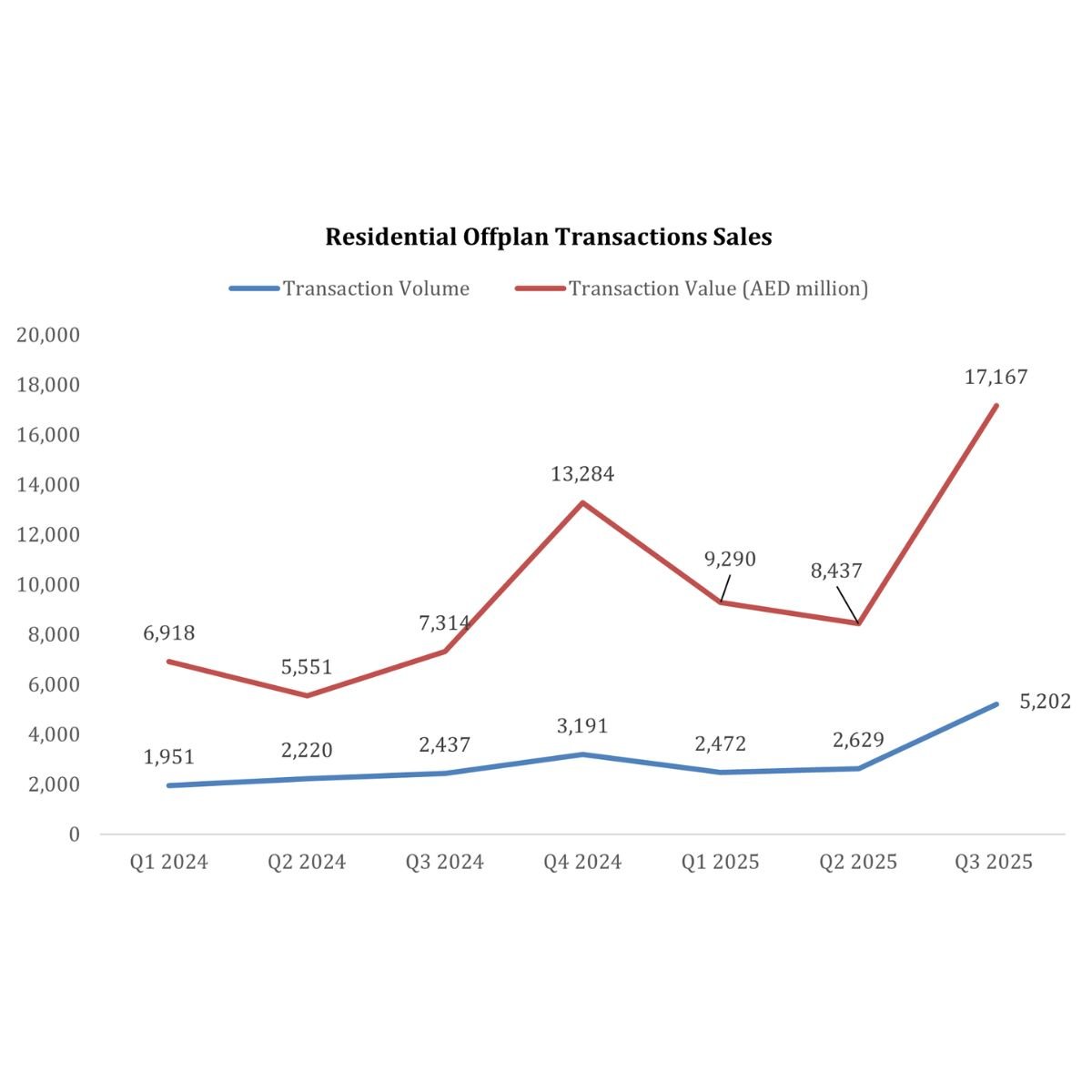

A significant portion of this growth came from off-plan projects, which made up 73% of all sales and 68% of transaction value. The off-plan segment surged by 136% to AED 17.3 billion, driven largely by landmark developments such as Fahid Island by Aldar and Al Hidayriyyat Island by Modon, together contributing around 30% of total off-plan value.

Investor appetite was particularly strong for apartments, where transaction values climbed 276%, highlighting growing interest in vertical, master-planned communities.

“The record-breaking performance we’re seeing in both Dubai and Abu Dhabi underlines the UAE’s position as one of the world’s most resilient and attractive property markets. Abu Dhabi is setting new benchmarks with sustainable, master-planned communities that are clearly resonating with buyers,” said Cherif Sleiman, Chief Revenue Officer at Property Finder.

Ready Homes Hold Steady Despite Rising Rates

While off-plan dominated the headlines, Abu Dhabi’s ready market also posted impressive gains, with AED 8 billion in transactions, up 71% year-on-year. The residential ready segment recorded AED 6.1 billion in value, rising 56%, supported by steady demand from both mid-tier buyers and luxury villa investors.

Activity was particularly robust in Al Reem Island, Al Raha Beach, and Saadiyat Island, reflecting continued end-user confidence despite elevated mortgage rates.

Dubai Strengthens Its Position as a Global Investment Hub

Dubai maintained its dominance as the UAE’s investment magnet, achieving its highest-ever quarterly transaction volume in Q3 2025. The data indicates a mature, value-driven phase, with investors focusing on long-term stability over speculative buying.

Off-plan transactions in Dubai climbed 26% year-on-year to 40,108 deals, accounting for 68% of total market volume and AED 82.9 billion in value — the highest quarterly figure on record.

Master-planned districts such as Business Bay, Al Barsha, and Dubai Islands continued to lead demand, reflecting investor confidence in well-integrated, high-potential communities. Business Bay alone saw AED 7.4 billion in sales, buoyed by fresh project launches and luxury resales.

Value-Driven Demand Defines Dubai’s Ready Market

Dubai’s ready sales segment contributed 32% of total volume with 18,936 transactions, marking a 2% rise in volume and a 16% increase in value to AED 86.1 billion. Analysts note that the demand shift from volume to value underscores investor caution amid global economic headwinds and reflects a maturing property ecosystem centered on capital preservation.

“Dubai’s shift towards value-driven demand shows a maturing market where investors are focused on long-term stability and wealth preservation. Together, these trends highlight the UAE’s strength as a global safe haven for real estate investment,” Sleiman added.

Key districts such as Palm Jumeirah, Marsa Dubai (Dubai Marina), and Wadi Al Safa 3 dominated the premium sales segment, with the latter generating over AED 7 billion in land transactions, driven by end-user developers and private investors.

Indian Investors Remain Active Participants

For Indian investors, the Dubai and Abu Dhabi real estate market Q3 2025 performance offers a clear signal of continued opportunity. With the UAE’s property sector offering freehold ownership, tax efficiency, and strong rental yields—averaging between 6% and 8%—many investors from India are using the strong rupee-dirham parity to expand their portfolios.

Off-plan projects, in particular, remain an attractive entry point for investors seeking capital appreciation, flexible payment plans, and long-term exposure to UAE’s expanding urban infrastructure.

Sustained Confidence Ahead

The Q3 results from Property Finder reaffirm the UAE’s enduring appeal as a safe and resilient real estate market. Both Abu Dhabi and Dubai continue to attract institutional and individual investors from across the globe, cementing their reputation as hubs for sustainable development and wealth creation.

With multiple mega-projects scheduled for launch in late 2025, analysts expect the UAE property sector to maintain its growth trajectory into 2026, supported by population expansion, policy stability, and international capital inflows.

Discover more from Invest Dubai Today - Dubai Realty Insights

Subscribe to get the latest posts sent to your email.